Ah, the ever-elusive quest to capture the coveted product/market fit: ensuring your product solves the right needs for the right set of users. While achieving product/market fit sounds simple, it’s easier said than done.

For Marketing, Product, and Sales leaders, it’s critical to continuously keep a finger on the product/market fit pulse and constantly consider who the right audience for a given product is.

This consideration can point you and your team in new and unforeseen directions. Sometimes, you may realize that your primary market is too small, too filled with competition, or your product is acting as more of a vitamin rather than a painkiller. Other times, you may want to expand to new personas at a company you’re already selling to (eg. you sell task management software to HR, but you want to sell to IT, too) or you want to expand into more industries but target the same job function (you still want to target HR professionals but expand from biotech to cybertech).

To help keep things simple, here’s a specific example we’ll use throughout this post: you wonder if your e-commerce analytics platform that helps retail brands uncover the sources of their lost revenue could be a fit not just for individual brands, but also web agencies who manage the sites of similar brands.

Whatever your catalyst for exploring new markets is, it’s important to have consistent methods in place for successfully pivoting or expanding a product from its original target segment to its BAM, or best adjacent market.

How to validate your BAM: 5 market research techniques

1. Clarify your value proposition

Why would someone buy your product? What is it solving for them? Do these personas fit with your product’s value proposition and your company’s overall strategy? Do you know the severity of the pain point for each buyer persona you’re selling to, and if it’s a real need (painkiller) or just a nice-to-have (vitamin)?

Understanding the answers to these core questions will provide clarity on the direction you should go in, and whether the pain points your product solves are specific to a certain industry (but multiple roles within an organization) or one type of role across multiple industries. A helpful starting point is to listen to Sales and CS conversations and pay close attention to the words your customers and prospects are actually using.

Our e-commerce analytics platform scenario is an example of expanding to a new type of organizational structure (in-house vs. agency), and a new persona within that structure (from e-commerce executives to Sales, Bizdev, or Account Directors).

2. Identify adjacent markets

2a. Industry research

Once you have an initial hypothesis on which new directions are worth pursuing, proceed with conducting general searches to find more information about org structures, how various departments relate and interact with each other, and adjacent functional areas.

You can also find helpful statistics (like the total % of revenue brands spend on website maintenance or the % of budget brands spend on digital tools) and analysis on certain industries from firms like Forrester and Gartner to help color in the full picture with supporting research.

2b. Past usage and sales data

The nice thing about having an existing product with existing customers is you should have a rich foundation of data to use as you consider new customer segments.

Quantitative data, including things like size of companies, size of departments within those companies, and average length of the deal cycle, will be a helpful starting point. Then, you should also consider qualitative data, like prospect call recaps from CS or Sales and insights from Marketing and Ops about the success of various demand gen campaigns.

Don’t hesitate to use these resources to your advantage as you progress in your research. Examples of this could look like setting up conversations with Marketing to get their thoughts on best demand gen approaches for targeting Sales and Bizdev agency execs, and interviewing your own Sales and Bizdev execs to get a more in-depth understanding of your new potential user.

3. Do some “back of the envelope” math to eliminate obvious no-go’s

After identifying user personas and org structures, you’ll need to be able to answer if there is a big and receptive enough market for your product to win in the short and long term. Tools like Zoominfo, Sales Navigator, or Lusha can help to identify the size of each market segment and give you a better understanding of your potential paths to success.

Using our example, we’d search for things like web agency job titles, organizational structure, average web agency size, number of e-commerce web agencies, and the number of brands who run their website in-house vs. through an agency.

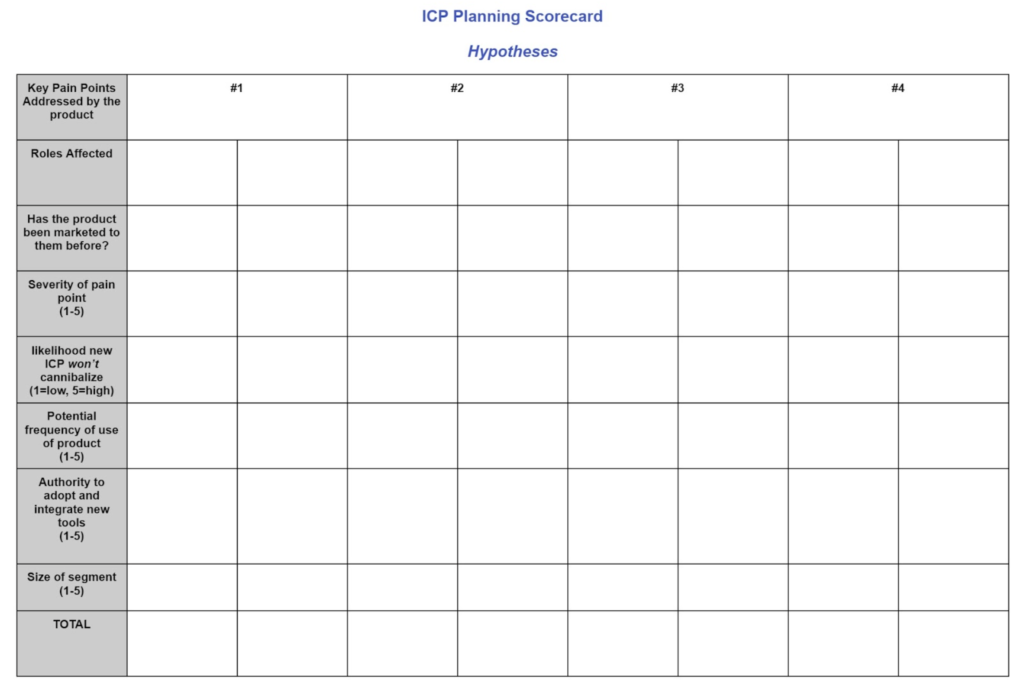

4. Build a scorecard + use it to further narrow down potential segments

After you’ve gathered enough qualitative and quantitative data to have a general list of potential adjacent markets, the next step is to put them through a ranking system – like this ICP planning framework – to see which ones can be eliminated and which one(s) to proceed with. By using a points system to rank a number of factors, you’ll be able to confidently eliminate the lowest ranking customer profiles and proceed full steam ahead to learn more about the top few.

5. Qualitative enrichment

Once you reach this stage, you should have gathered enough information to make a well-informed BAM hypothesis. Enriching your hypothesis with even more qualitative feedback – like a survey to your database of prospects or market research interviews with connections who fit your target persona – will help confirm whether you’ve shot the bullseye or you need to go back to the drawing board.

Let’s revisit the e-commerce analytics platform example one more time. By surveying and interviewing Sales, Bizdev, and Account execs from web agencies, you might get strong confirmation that your product solves a huge pain point for them – eliminating time and resources that would have been wasted digging through a mess of analytics. But, you might also hear responses that challenge your hypothesis or bring up blockers you didn’t consider, like web agencies have to jump through a lot of hoops to make any changes to client websites, or brands who work with agencies prefer to manage their own analytics platform subscriptions.

The Bottom Line

No matter the size or vertical of your company, using these market research techniques will give you clear information on the best adjacent market for your product – and whether the fit is strong enough to pursue, or too forced to be worthwhile.